7.1. Electricity and Capacity Sales

7.1.1. Competitive Environment in the Electricity and Capacity Market

In order to increase competitiveness on the electricity market, JSC TGC-1 carries out activities aimed at the solution of the problem of closed capacities, the optimization of the structure of generation at CHPPs and HPPs, the introduction of new technologies, and the process refurbishment performance. The regions of JSC TGC-1 presence are characterized with the increasing industrial capacity, which facilitates the increase in the Company’s electricity useful output.

The primary competitive advantages of JSC TGC-1 are:

– the price advantage of the Company’s CHPPs in regard to combined generation (as compared to GRES);

– a high percentage of the HPP generation in the total volume of electricity generation and the HPPs’ price advantage in comparison with thermal power plants;

– a capability of rapid change of a HPP’s active load and electricity delivery in the conditions preset by the System Operator;

– the territorial location of the Company’s power plants determining a capability of electricity exports.

Along with JSC TGC-1, the activity for electricity and capacity generation on the territory of Saint Petersburg, the Republic of Karelia, and the Leningrad and Murmansk Oblasts is carried out by Rosenergoatom Concern OJSC (represented by Leningrad and Kola Nuclear Power Plants), JSC OGK-6 (represented by Kirishskaya GRES), and JSC Inter RAO UES (North-West CHPP), which carries out electricity delivery for export.

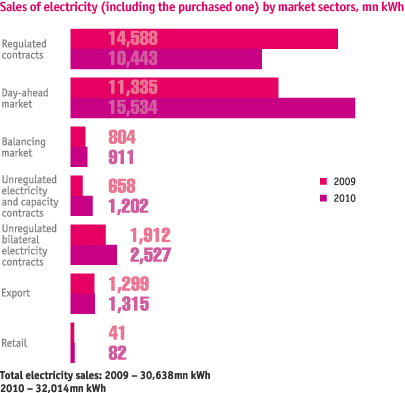

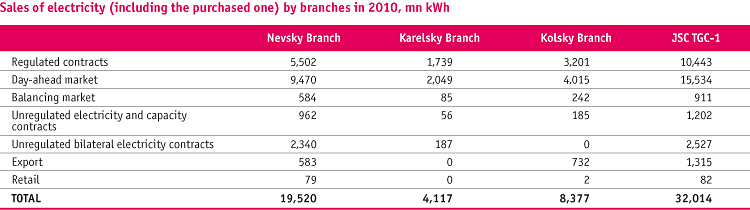

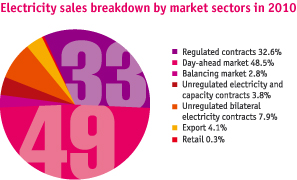

7.1.2. Electricity Sales

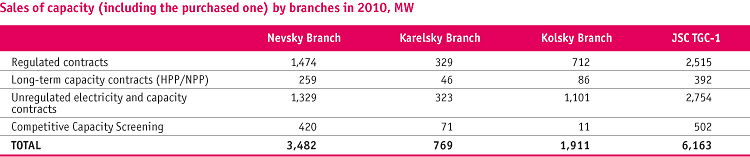

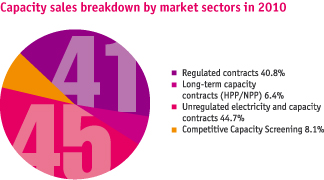

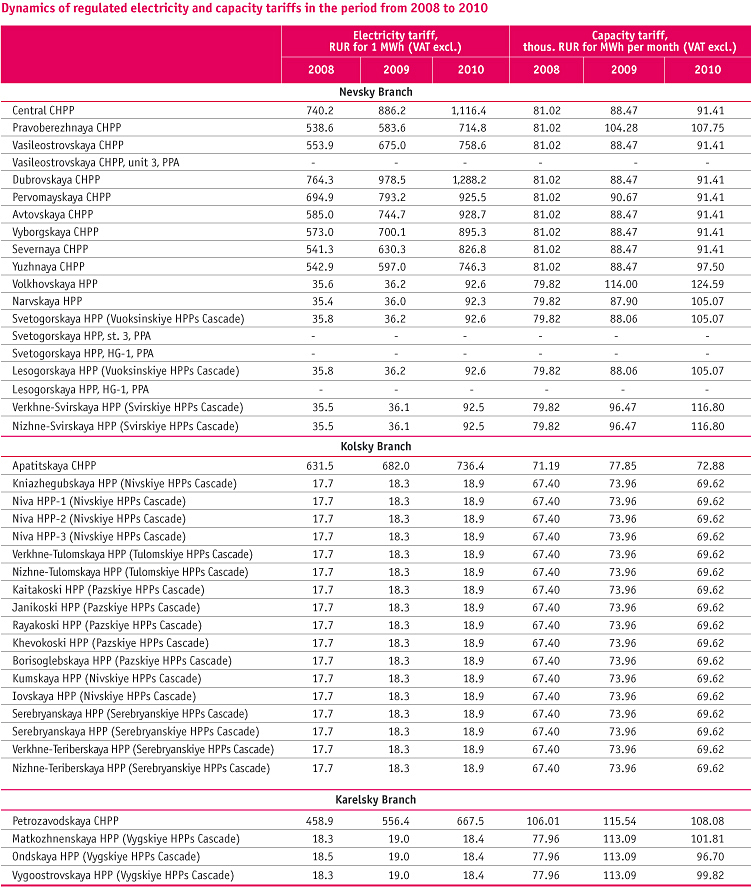

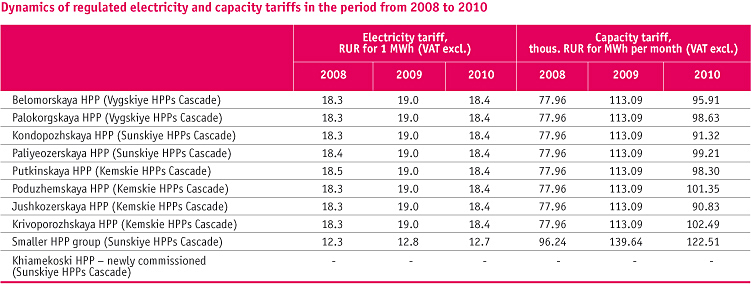

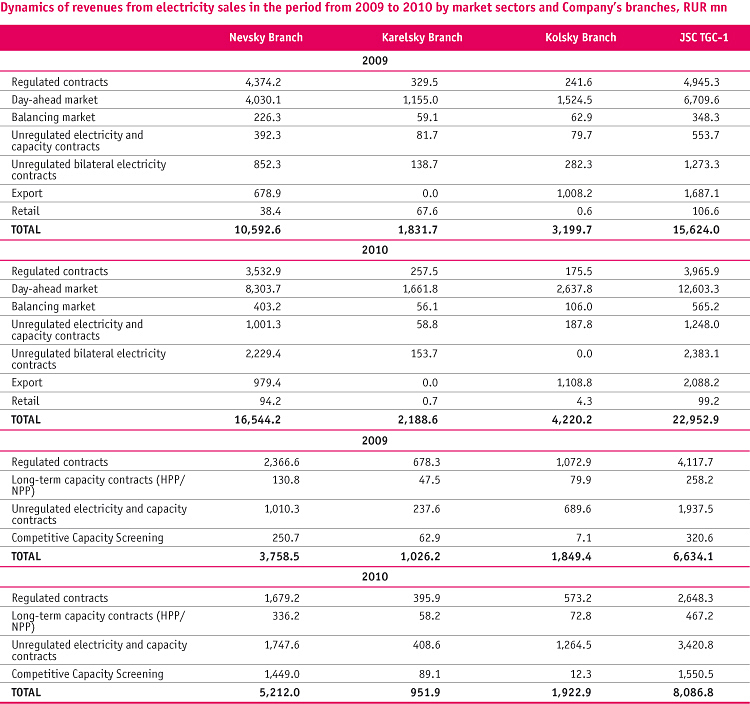

In 2010, the settlements for electricity supplied to the market of the

wholesale market regulated contracts were carried out as per the

tariffs for electricity and capacity established by FTS of the Russian

Federation for each power plant of the Company individually.

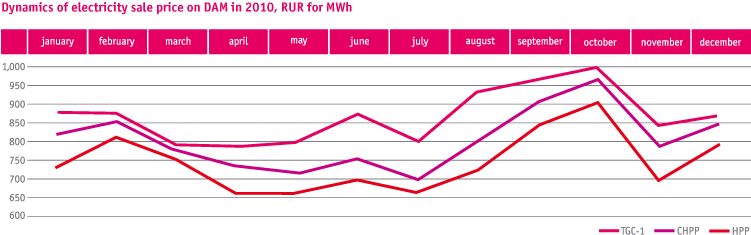

The settlements for electricity supplied to the day-ahead market

and the balancing market were carried out as per the tariffs formed

on the basis of competitive bids of participants in the tenders.

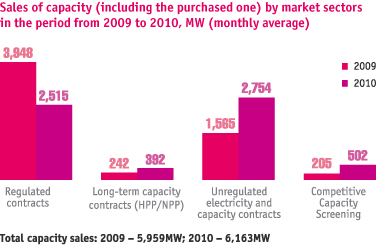

The settlements for capacity supplied to the market of the wholesale

market regulated contracts were carried out as per the FTS tariffs,

while that for long-term capacity contracts and competitive

capacity screening were carried out as per the prices approved by

NP Market Council. Also, the settlements for electricity supplied

to the unregulated bilateral electricity contracts market and that

for electricity and capacity supplied to the unregulated electricity

and capacity contracts market were carried out against free (nonregulated)

contracts.

Heat tariffs are approved by regional regulatory bodies by consumer

groups.

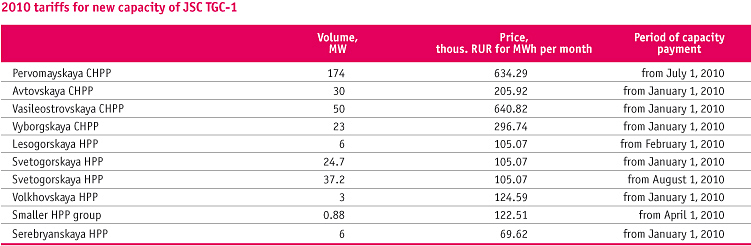

According to the results of competitive capacity screening conducted in 2009, the entire new equipment passed the selection procedure, and NP Market Council approved the following 2010 tariffs for facilities to be commissioned:

On 8 December 2010, the first competitive capacity screening for

2011 was conducted in accordance with the new rules.

|

On the results of competitive capacity screening for 2011, the maximum price for capacity was established in the amount of: in the European energy zone: RUR 118.1 thousand for 1MW, in Siberia: RUR 126.4 thousand for 1MW, and in the free flow zones of the Centre and the Ural: RUR 123 thousand for 1MW. |

The first campaign for the power purchase agreements execution was finished in December 2010

7.1.3. Electricity and Capacity Purchase

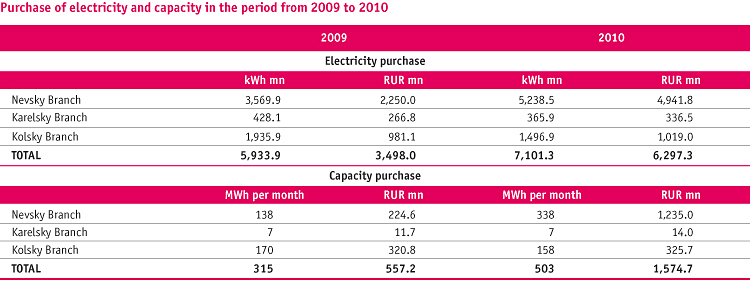

The primary reasons for electricity purchase in 2010 were as

follows:

– purchase of generation as a provision for unregulated electricity

and capacity contracts;

– purchase as a provision for export deliveries;

– purchase as a provision for obligations against regulated

contracts due to removal of equipment for repairing.

The primary reasons for capacity purchase in 2010 were as

follows:

– a fine for non-availability of the system of technological

information exchange with automated system operator (ASO

TIES);

– emergency shutdowns of equipment and unscheduled start-ups /

stops of equipment.

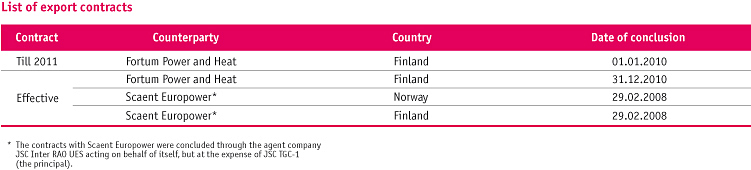

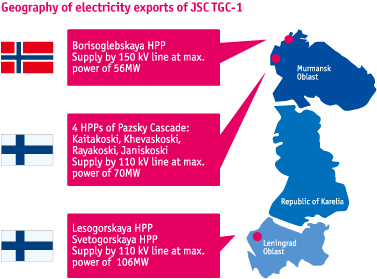

7.1.4. Electricity Exports

JSC TGC-1 is capable to export a part of the generated electric

power thanks to a unique geographical location of a number of its

power plants. To date, export deliveries are carried out to Finland

and Norway. One of the directions of export deliveries can also

become Estonia.

The volume of export sales in all directions amounted to about

1,315mn kWh in 2010.

The next one-year contract with Fortum Power and Heat has been

concluded for the year of 2011. The effect of three-year contracts

with Scaent Europower has been also prolonged till the end of 2011.

Minor adjusting alterations have been entered into the contracts; on the whole, the contractual structure has been retained without

essential modifications.

7.2. Heat Sales

7.2.1. Competitive Environment in the Heat Market

The largest participants of the heat market of the North-West Federal

District:

• JSC TGC-1;

• GUP TEC Saint Petersburg;

• Peterburgteploenergo LLC;

• Izhora-Energosbyt LLC;

• ZAO Lenteplosnab;

• JSC Inter RAO UES (North-West CHPP);

• Kirishskaya GRES (JSC OGK-6);

• Leningrad Nuclear Power Plant (Rosenergoatom Concern OJSC);

• GOUTP TECOS.

Along with the above listed companies, a number of local boiler facilities

operate in the region.

7.2.2. Establishment of JSC Saint Petersburg Heating Grid

|

Governent federal state unitary enterprise TEC Saint Petersburg (TEC SPb) is the principal competitor of TGC-1 on the heat supplies market of Saint Petersburg. Among its assets, TEC SPb possesses 226 boiler facilities of the 7,784.5 Gcal/h installed capacity. The annual output heat is 14mn Gcal, the annual volume of sales is over 17mn Gcal. The heating system length is 3,558.9 km. |

JSC Saint Petersburg Heating Grid was established on the basis

of the JSC TGC-1 structural division of on February 1, 2010.

The foundation of JSC Saint Petersburg Heating Grid was provided

for by the three-party agreements between the Saint Petersburg

Administration, JSC TGC-1, and TEC SPb for the purpose of

integration of heating grids in the area of operations of JSC TGC-1

CHPPs.

At the initial stage, JSC Saint Petersburg Heating Grid will operate

transferred to it the internal block grids owned by TEC SPb and

the heating mains belonging to JSC TGC-1, located in the area of

operations of JSC TGC-1 CHPPs, on a leasehold basis.

In December 2010, FFMS of the Russian Federation registered the

additional share issue of JSC Saint Petersburg Heating Grid, in

which TEC SPb and JSC TGC-1 will be the parties. On 31 December

2010, JSC Saint Petersburg Heating Grid and JSC TGC-1 entered into

the contracts for purchase of ordinary shares of JSC Saint Petersburg

Heating Grid by JSC TGC-1 with payment of the assets included

in the balance of the enterprise Heating Grid of the Nevsky

Branch of JSC TGC-1. The shares in the authorized capital of

JSC Saint Petersburg Heating Grid will be distributed upon the

additional emission completion as follows: JSC TGC-1 – 74.99%;

TEC SPb – 25% + one share.

Consolidated operation of these grids will make it possible to

more efficiently distribute funds for repair and renovation of

the pipe mains and perform an integrated control over the process

of heat supply from a source to a nodal point of particular buildings

connection, as well as to enhance the operational efficiency of

response of the operational services to messages on contingency

situations. The foundation of JSC Saint Petersburg Heating

Grid will also ensure the attraction of target investments in

the development of the heat sector.

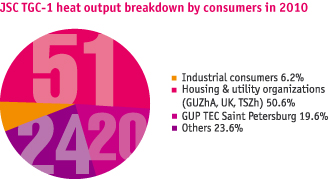

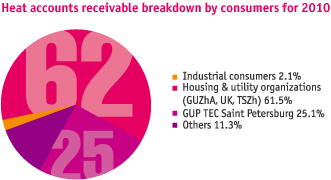

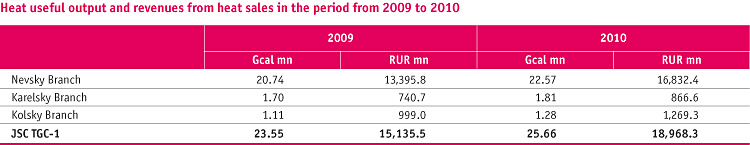

7.2.3. Heat Sales Key Indicators

JSC TGC-1 carries out sales of heat as per the tariffs approved by regional regulatory bodies by consumer groups.

The overall heat useful output to consumers from the JSC TGC-1

power plants (excluding Murmanskaya CHPP) amounted to

25.66mn Gcal in 2010 versus 23.55mn Gcal in 2009. The revenue

from delivered heat increased by 25.3% to the amount of

RUR18,968.3mn.

Electricity and heat tariffs were increased with a view to ensuring

stable operation JSC TGC-1 for reliable energy supply to consumers

and implementation of the investment programme for powergenerating

equipment development and renovation, taking into

account the fuel price advance and the inflationary tendencies.