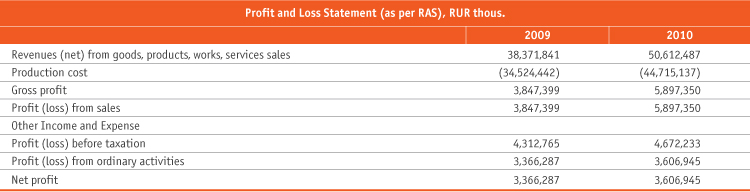

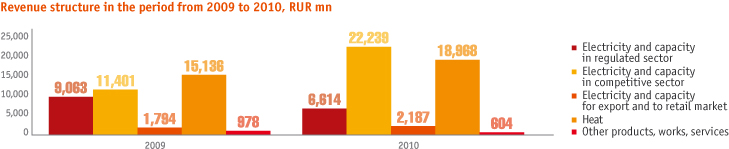

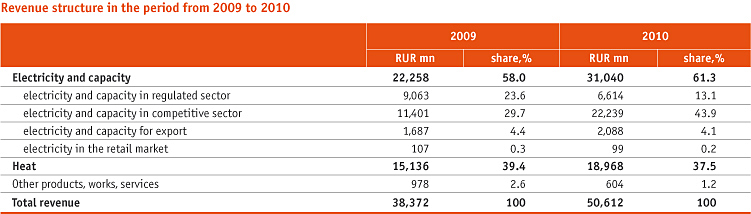

10.1. Financial Performance Analysis as per RAS

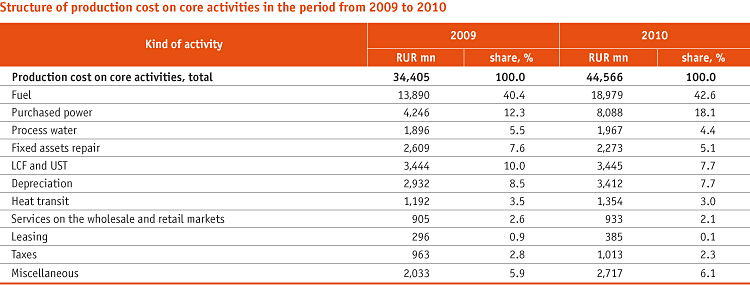

The profitability of the Company’s sales on the results of the 2010 fiscal year increased by 11.65% versus 10.03% in 2009. This growth was caused by the priority rates of the revenue increase as opposed to the growth of expenses for production and sales of products, works and services. The expenses for electricity (RUR25,478mn) and heat generation (RUR19,087mn) comprise the main fraction of the production cost.

The production cost on core activities increased by RUR10,161mn

versus 2009.

The primary reason for the production cost change is the increase

in expenses for fuel due to the production programme expansion at

CHPPs and for purchase of energy and capacity for providing free

contracts and export deliveries.

Significant deviations in the heat cost structure are connected

with the change of the contractual relations in the operation of

the internal block grids owned by TEC SPb and the heating mains

belonging to JSC TGC-1:

– the refusal from the scheme of rendering services for heat transfer

via the internal block grids since January 1, 2010 and transition to

the scheme of their lease and maintenance (accordingly, the growth

in the “Leasing” and “Miscellaneous Expenses” items);

– the execution of the contract with JSC Saint Petersburg Heating

Grid for heat transfer via the internal block grids and the JSC TGC-1

heating mains from June 1, 2010 (recognition of the expenses

against the heat transfer contract by the “Heat Transit” item and

the loss purchase by the “Services on Wholesale and Retail Markets”

item).

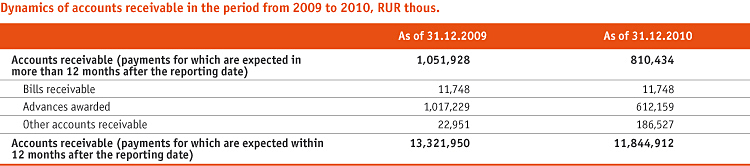

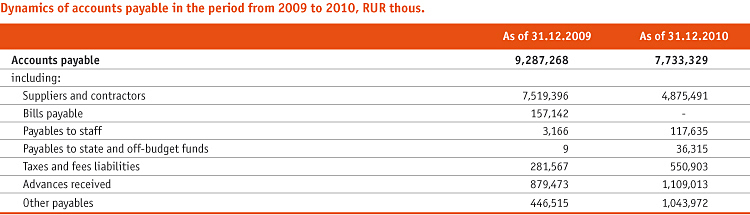

The reduction of the total amount of the accounts payable in the period from 2009 to 2010 is caused by the decrease in the accounts payable to construction organizations, repair agencies, and other suppliers and contractors.

10.2. Financial Performance Analysis as per IAS

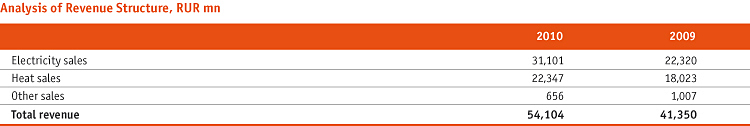

In 2010, the Company’s consolidated revenue increased by 31% as

compared to 2009 and amounted to RUR54,104mn. The following

factors had the main impact on the revenue growth:

• the electricity generation and heat output growth;• the advance of regulated and free prices for electricity and

capacity;

• the growth in heat tariffs;

• the gain in electricity and capacity sales as a result of the market

liberalization.

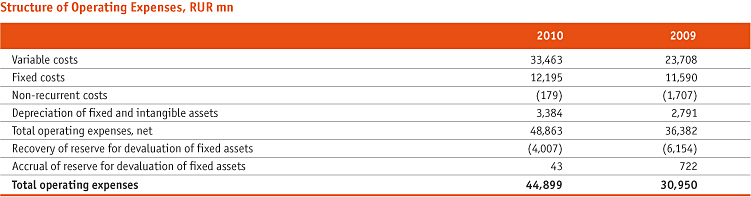

The operating expenses increased by 45% versus the previous reporting period to RUR44,899mn in 2010. The basic gain fell to the variable costs, namely, 70% of the gross growth of the operating expenses in 2010.

Primary reasons of the increase in the variable costs:

• the increase in expenses for fuel due to the substantial growth of

energy generation at CHPPs and the fuel price advance;

• the increase in expenses for purchase of energy and capacity on

the wholesale market for providing the execution of terms and

conditions of free contracts and export deliveries;

• the increase in expenses for electricity purchase due to the price

rise on the day-ahead market (DAM).

The fixed costs are under the control of the Company’s management.

In 2010, they grew to RUR12,195mn, which is 5% more as compared

to 2009. This growth is within the range of the inflation rate in the

Russian Federation for 2010 equaled to 8.8%.

Eventually, the operating profit for 2010 as per IAS decreased

by 11% versus 2009 and amounted to RUR9,205mn, while

the profit after taxation decreased by 14% versus 2009 down to

RUR7,173mn.