7.1. Financial Results Analysis

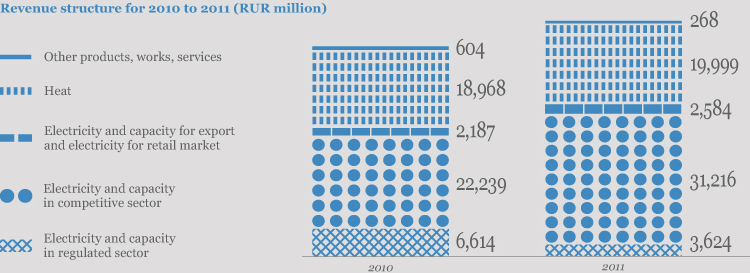

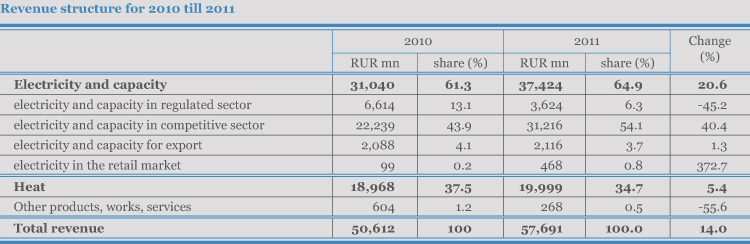

Based on the results of 2011, TGC-1’s revenue increased by 14 % compared to 2010 and equaled RUR 57,691 million. The growth of total revenue is due to increase of electricity and capacity sales which is a result of the wholesale market liberalization and increase of the power plant generation, increase of regulated and free-trade electricity and capacity prices, commissioning of new CCGT units at the Pervomayskaya CHPP and Yuzhnaya CHPP under the capacity supply contract, and growth of heat output tariffs.

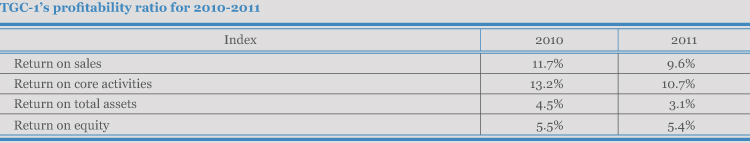

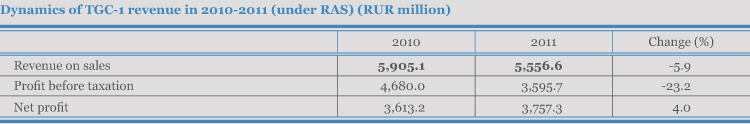

The profitability of the Company’s sales at the end of the 2011 fiscal year decreased to 9.63 % compared to 11.67 % in 2010, which is due to a slight reduction in the gross profit.

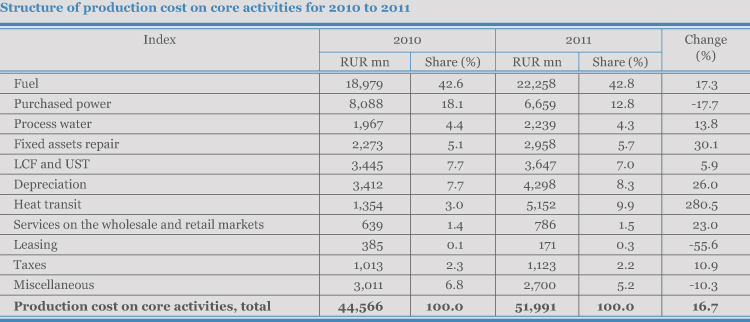

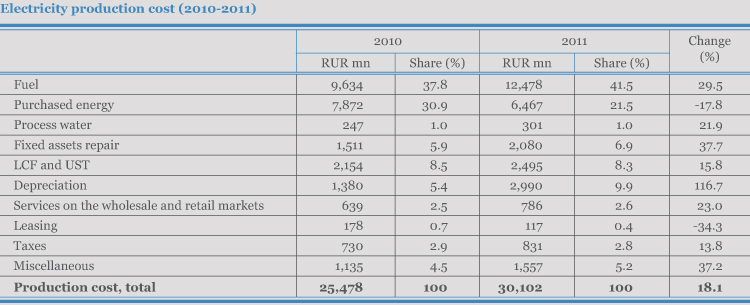

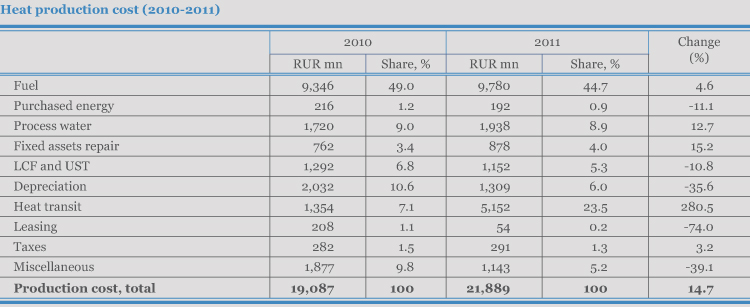

The production cost of core activities increased by RUR 7,425 million compared to 2010. The primary reason for the production cost’s change is the increase in expenses for fuel due to the production programme’s expansion at CHPPs, increase of process water expenses due to the tariffs’ growth, increase of depreciation and taxes costs due to commisioning of the power generating units at the Pervomayskaya CHPP and Yuzhnaya CHPP.

Significant deviations in the production cost structure are connected with establishment in June 2010 of a subsidiar, Saint Petersburg Heating Grid, which provides heat transit services (Heat transit item in the heat transit contract).

7.2. Financial Performance Analysis

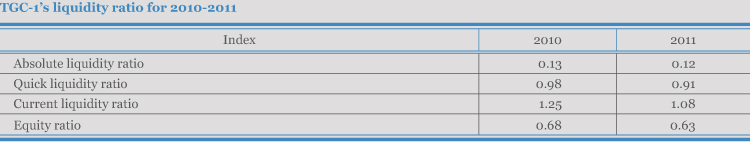

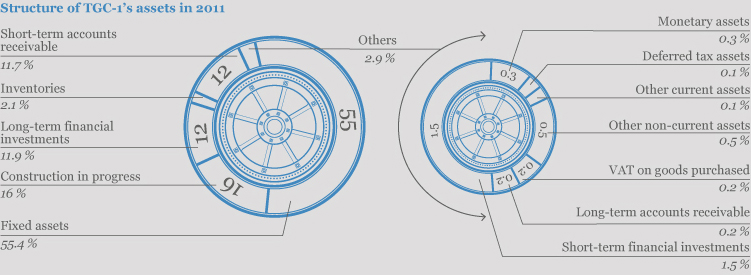

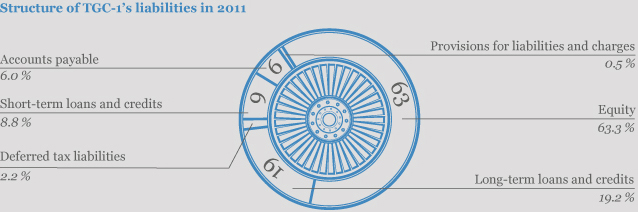

As of 31 December 2011, the balance amount totals RUR 115,843,052 thousand. Non-current assets account for 84.0% of the Company’s assets. Compared to 2010, the cost of fixed assets increased by RUR 7,633,710 thousand as a result of commissioning of new power generating facilities in compliance with implementation of the investment programme.

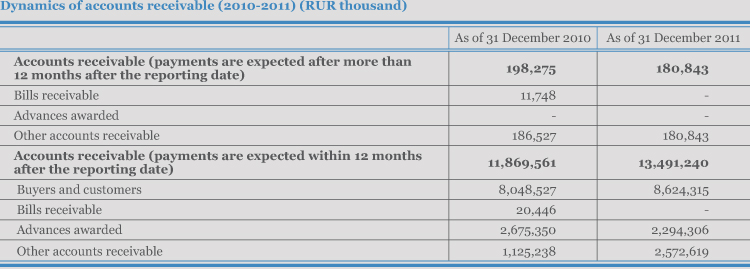

The increase of the total amount of accounts receivable in the accounting period is mainly from the growth of other accounts receivable resulting from over-payment of federal and local taxes.

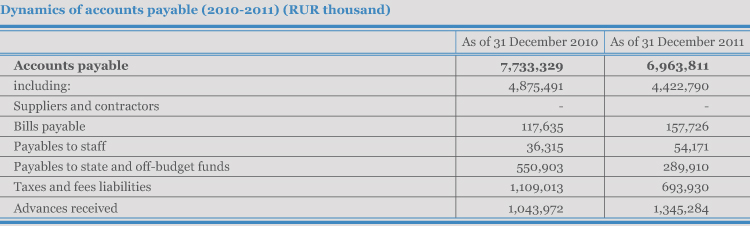

In 2011, the Company actively borrowed to finance its investment activities. Increase of borrowings share in the Company’s capital is within an acceptable level required for the Company’s financial stability.