ANNEX 1.

Reference Information for Shareholders and Investors

Information about TGC-1’s Registrar

The specified registrar has maintained the registration of issuer’s securities since 23 December 2010.

Information about TGC-1's Auditor

Bank Details

TIN 7841312071, TRRC (Tax Registration Reason Code) 780501001

Bank account No. 40702810309000000005

in Bank ROSSIYA

Saint Petersburg

Correspondent account No. 30101810800000000861

BIC 044030861 PSRN 1057810153400

RNNBO 76201586

Contact Information:

TGC-1

Antonina Maksimova

Head of the Corporate Management Department

Tel.: +7 (812) 901-3131

Fax: +7 (812) 901-3595

Е-mail: Maksimova.AN@tgc1.ru

Ekaterina Shpungina

Head of the Investor Relations Sector

Tel.: + 7 (812) 901-3297

Fax: +7 (812) 901-3595

E-mail: Shpungina.ES@tgc1.ru

Viktor Nesterov

Corporate Secretary

Head of the Shareholder Relations Department

Tel.: +7 (812) 901-3591

Fax: +7 (812) 901-3595

Е-mail: Nesterov.VV@tgc1.ru

The Bank of New York Mellon (Depositary bank of the GDR program of TGC-1)

Vladimir Kotlikov (New York)

The Bank of New York Mellon Depositary Receipts

ADR Division/EEMEA

Tel.: (212) 815 5948

Fax: (212) 571 3050

vladimir.kotlikov@bnymellon.com

Irina Baichorova (Moscow)

Tel.: +7 (495) 967-31-10

Fax: +7 (495) 967-31-06

irina.baichorova@bnymellon.com

ANNEX 2

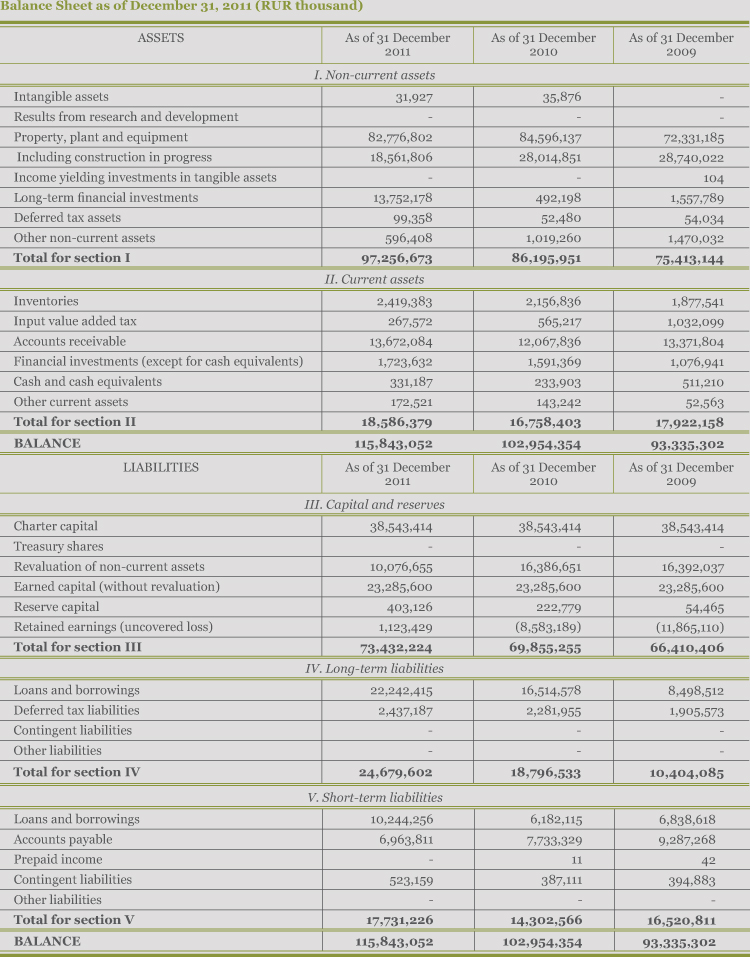

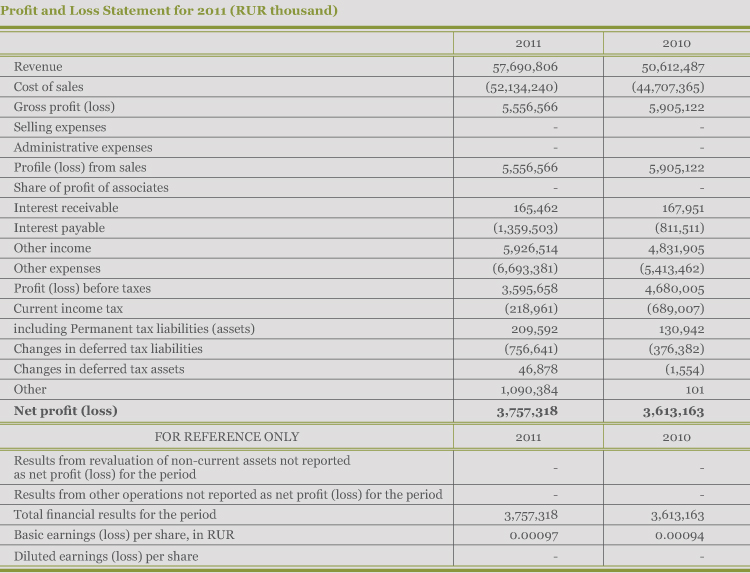

Abridged Financial Statements of TGC-1 for 2011 under Russian Accounting Standards

Auditor’s Report

To the shareholders of Territorial Generating Company No. 1 Joint Stock Company:

Auditee

Territorial Generating Company No. 1 Joint Stock Company

Certificate of state registration of an open joint stock company entered into the Unified State Register

of Legal Entities under principal state registration No. 1057810153400, issued on March 25, 2005

by Inter-District Inspectorate of the Federal Tax Service No. 15 for Saint Petersburg.

6 Bronevaya, Litera B, Saint Petersburg, Russia, 198188.

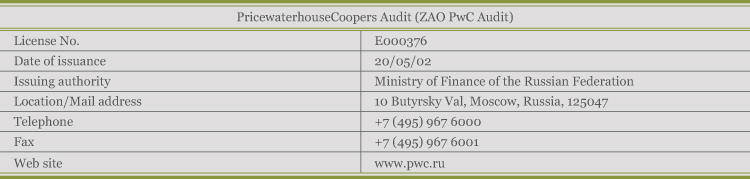

Auditor

PricewaterhouseCoopers Audit (ZAO PwC Audit)

10 Butyrsky Val, Moscow, Russia, 125047

State registration certificate No. 008.890, issued by Moscow Registration Bureau on February 28, 1992.

Certificate of entry in the Unified State Register of Legal Entities of a legal entity registered before July 1, 2002 No. 1027700148431, issued by Inter-District Inspectorate of the Russian Ministry of Taxes and Levies No. 39 for Moscow on August 22, 2002.

A member of Audit Chamber of Russia Self-Regulated Non-Profit Partnership (under registration number 870 in the register of Audit Chamber of Russia members).

Principal registration number of entry (ORNZ) in the register of auditors and auditing companies: 10201003683.

We have audited the accompanying financial statements of Joint Stock Company Territorial Generating Company No. 1 (hereinafter – the Company), which comprise the balance sheet as at December 31, 2011, profit and loss statement, statement of changes in equity and cash flow statement for 2011, other annexes to the balance sheet and profit and loss statement and the related explanatory notes (hereafter referred to as “financial statements”).

Company’s Responsibility for the Financial Statements

Management of the Company is responsible for the preparation and fair presentation of these financial statements in accordance with the financial reporting framework applicable in the Russian Federation, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with federal auditing standards and international auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audits to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of 31 December 2011 and its financial performance and cash flows for the year 2011 in accordance with the financial reporting framework applicable in the Russian Federation.

Signature

Director of ZAO PricewaterhouseCoopers Audit

Vyacheslav Sokolov

March 1, 2012

Signature

General Director

Andrey Filippov

Signature

Chief Accountant

Raisa Stanishevskaya

ANNEX 3

JSC Territorial Generating Company No. 1 Audit Committee Report for the Year 2011

| Moscow | 12 April 2012 |

The Audit Committee, elected by the General Shareholder Meeting and having as its members

Evgeny Zemlyanoy (commission chairman), Irja Vekkila, Vitaliy Kovalev, Svetlana Dasheshak and Yuri Linovitsky, has audited the financial and business operations of TGC-1 in 2011.

The financial statements of the Company for the year 2011 were prepared under Federal Law

No. 129-FZ “On Accounting” dated 21 November 1996, the Regulation on Accounting and Financial Reporting in the Russian Federation adopted on 29 July 1998 by decree No. 34n of the RF Ministry of Finance, the accounting forms approved on 2 July 2010 by decree No. 66n of the RF Ministry of Finance and other accounting and financial reporting regulations.

Management of the Company is responsible for the fair presentation of the financial statements.

ZAO PricewaterhouseCoopers Audit, the Company’s auditor, audited the financial statements of the company for the period from 1 January 2011 to 31 December 2011 (the auditor’s report of 1 March 2012). In auditor’s opinion, the financial statements of TGC-1 present fairly, in all material respects, the financial position of the Company as of 31 December 2011.

The Company conducts its business in accordance with the RF laws and the Articles of Association.

For the year 2011, the Company reported a net profit of RUR 3,757,318 thousand. As of 31 December 2011, the Company had net assets of RUR 73,432,224 thousand.

Based on the audit results, the audit commission has reasonable grounds to believe that the annual report and financial statements of TGC-1 for the period from 1 January 2011 to 31 December 2011 present fairly, in all material respects, the financial position of the Company.

Signature

Audit Committee Chairman,

Evgeny Zemlyanoy

Signature

Audit Committee Secretary,

Yuri Linovitsky

Audit Committee members:

Signature

Irja Vekkila

Signature

Vitaliy Kovalev

Signature

Svetlana Dasheshak

ANNEX 4

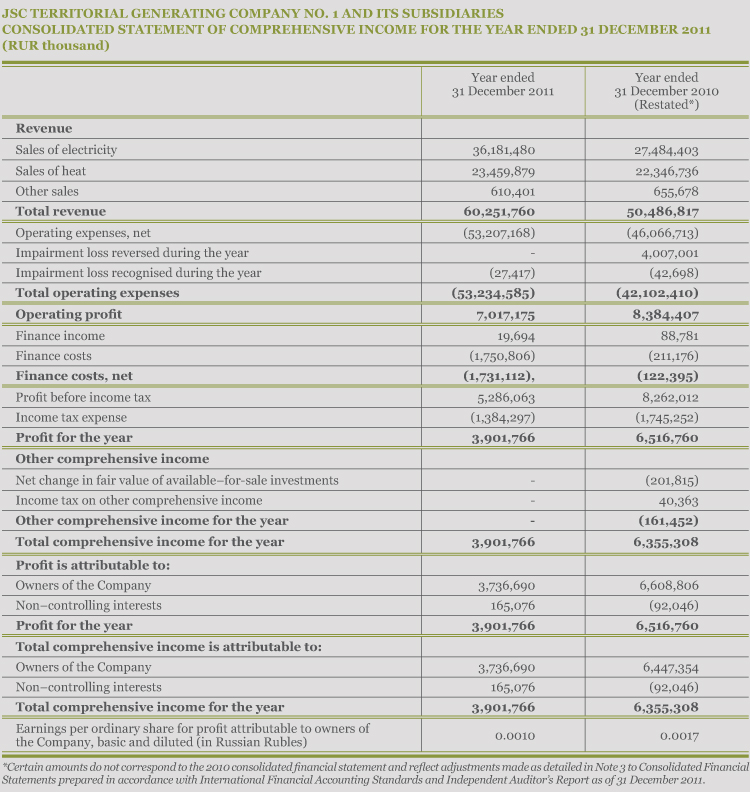

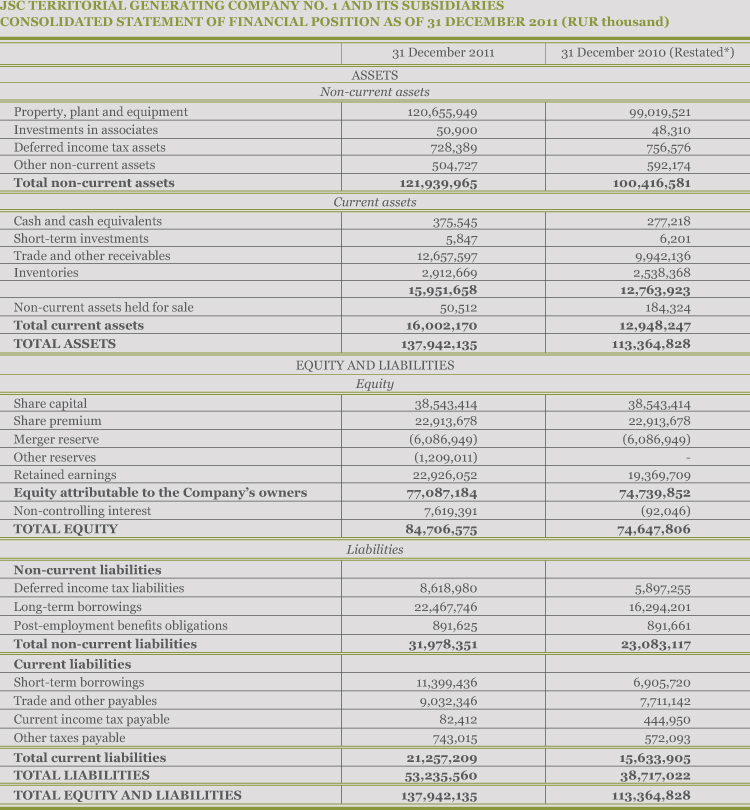

Abridged Consolidated Financial Statements of TGC-1 for the Year 2011 under International Financial Accounting Standards

Independent Auditor's Report

To the Shareholders and Board of Directors of Joint Stock Company Territorial Generating Company №1:

We have audited the accompanying consolidated financial statements of Joint Stock Company Territorial Generating Company №1 and its subsidiaries (the "Group"), which comprise the consolidated statement of financial position as at 31 December 2011 and the consolidated statements of comprehensive income, changes in equity and cash flows for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management's Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

Auditor's Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Groupas at 31 December 2011, and its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards.

23 April 2012 Moscow, Russia

Approved for issue and signed on behalf of the Board of Directors on 23 April 2012.

General Director

Andrey Filippov

Chief Accountant

Raisa Stanishevskaya