|

Annual report 2006 JSC "TGC-1" |

|

7. RUSSIAN ELECTRICITY MARKET OVERVIEW

According to the International Energy Agency, the International Atomic Energy Agency and several national sources, Russia’s electricity sector is among the largest in the world:

- fourth in terms of both installed generation capacity and electricity output behind the United States, China and Japan;

total installed capacity as of the end of 2006 amounted to approximately 220 GW; - electricity output in 2006 reached 991.42 billion kWh, representing a 4.0% increase over 2005.

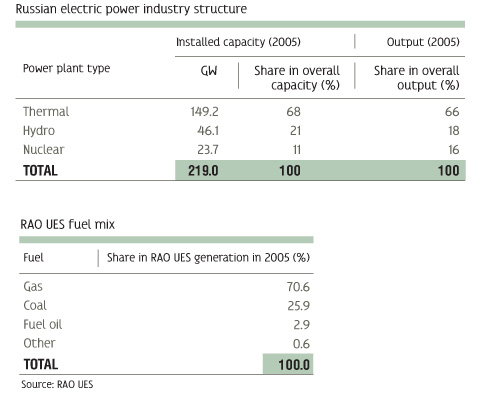

Russian electricity supply is provided by a mixture of thermal, hydro and nuclear capacity. Thermal capacity plays the key role, accounting for a significant majority of installed capacity and acting as the price-maker in the growing free market sphere. Key sector players include the Unified Energy System of Russia (RAO UES), a 53% state-controlled holding company owning stakes in companies spanning the entire electricity supply value chain (including wholesale and territorial generating companies); Rosenergoatom,

a 100% state-owned company which owns and operates Russian nuclear power plants; and independent producers, of which the largest are four integrated

utilities — Irkutskenergo, Tatenergo, Bashkirenergo and Novosibirskenergo.

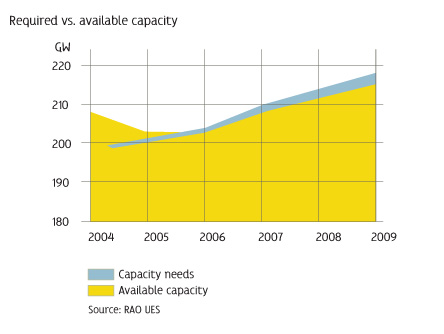

According to Russian Government forecasts, electricity demand will increase by 5% per year till 2011, thereby energy consumption has to increase from

984 billion kWh in 2006 to 1,198 billion kWh in 2010, and the need for additional generating capacities will consequently arise.

To keep pace with the expected rates of economic growth and to ensure the reliability of the country’s power supply, the comprehensive reform is currently being implemented to stimulate inflow of private capital into the industry.

The main objective of electric power industry reform in Russia is an increase of industry plants effectiveness; providing conditions for industry dynamics based on investment stimulation; guarantee of reliable no-break energy supply to customers.

The reform has three key pillars which together aim to transform the industry and accelerate its development:

Asset re-bundling by business activity. RAO UES has broken down most of its subsidiaries (“AO-energos”, vertically integrated regional utility companies) into smaller separate companies by line of business and subsequently re-bundled them into more sizable stand-alone companies engaged in electricity and heat generation, transmission (high-voltage trunk grid infrastructure), distribution (medium- and low-voltage grid infrastructure) and supply. The principal aim of this exercise remains to separate potentially competitive enterprises from monopolistic services in order to enable private investment into the competitive sectors (power generation and supply).

Electricity market liberalization. One of the key reasons for the current state of Russia’s power sector (capacity deficit, obsolescence of existing capacity) is acute historical under-investment in the industry. This was a product of artificially low government-regulated tariffs which failed to provide sufficient incentives to attract new capital. The Russian Government recognizes that private investment is now necessary to take sector development to a level where it can support economic growth and assure reliability of supply and, to this end, a gradual liberalization of the electricity market is planned over the medium-term.

Additional share issues and sale of government shares in generating companies. Following the completion of asset re-bundling and in parallel with the liberalization process, opportunities are being offered for external investors to take stakes in Russia’s newly-formed generation businesses (WGCs and TGCs) by acquiring both additional and existing shares.

Asset re-bundling by business activity

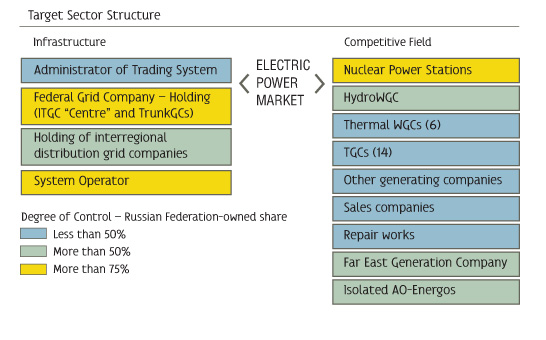

The aim of asset re-bundling by business activity is to create competitive markets in generation and supply while retaining monopolies in transmission, distribution and dispatching services.

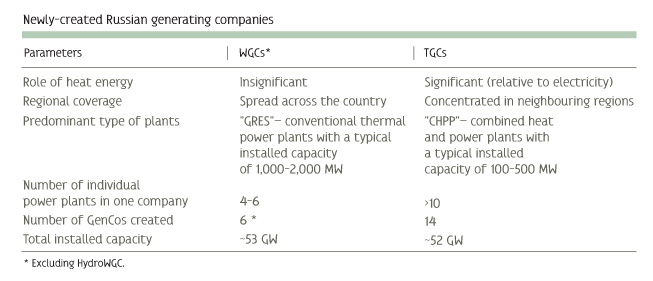

In particular, RAO UES-controlled generating assets are being repackaged into 21 new generating companies (6 thermal WGCs (“wholesale generating companies”), 14 TGCs (“territorial generating companies”) and one HydroWGC). To date, this process has been completed for all thermal WGCs and for most TGCs.

Wholesale market liberalization

The Russian electricity market consists of two principal sub-markets — electricity and capacity: electricity sales represent the transfer of rights to consume electricity to the purchaser, and capacity sales represent a “stand-by” obligation on the part of the seller to be able to generate up to a certain volume of electricity for the benefit of the buyer regardless of whether or to what extent this obligation is actually called upon.

In a regulated market segment, environment capacity tariffs are generally set at a level enabling the generator to recover its fixed costs, while electricity tariffs are set at a level enabling the recovery of variable costs associated with power generation.

As the market is liberalized, it is expected that marginal cost pricing will prevail in each respective market.

Following the first steps towards liberalization and the launch of the so-called New Wholesale Market of Electricity and Capacity (“NOREM”) in September 2006, the Russian wholesale electricity market currently operates as follows:

In the regulated market segment, presently accounting for 95% of planned 2007 electricity generation, electricity and capacity are sold under regulated bilateral contracts. Regulated bilateral contracts are a temporary structure ensuring a smooth transition from a fully-regulated environment to a fully-free market and prescribe take-or-pay obligations for the electricity and capacity volumes fixed therein at a regulated tariff.

In a free market segment, generators can engage in electricity trading for all deviations from volumes prescribed by the regulator for the regulated segment.

Non-regulated bilateral contracts. Non-regulated bilateral contracts can be executed between two willing counterparties, providing for medium- and long-term power supply/purchase at commercially agreed prices. The take-or-pay contract mechanics are otherwise identical to regulated bilateral contracts.

“Day-ahead” spot market. The spot market is a competitive day-ahead market, where prices are formed for each hour by matching bids and offers of market players to reach balance for a given hour. While regulation remains high, the spot market is mainly used to fine-tune the rough generation/consumption profiles prescribed by bilateral contracts, although market players may also use it to extract additional arbitrage profits — for example, by replacing their prescribed generation volume with electricity acquired more cheaply on the spot market and sold at the regulated tariff.

Balancing market. The balancing market is a real-time, fine-tuning mechanism where any deviations in actual consumption requirements over those bilaterally contracted and further augmented by spot market sales are covered.

The Federal Tariff Service of Russia (a government regulatory body) has historically set both electricity and capacity tariffs one year in advance on a “cost-plus” basis. 2007 was the last year the regulated tariffs have been explicitly set, and it is envisaged that from 2008 and beyond, regulated tariffs will be automatically raised in line with cost factor inflation. This will create multiple new profit optimization opportunities for generators as previously any cost reductions would be reflected in relatively lower tariffs the following year (as compared to what they otherwise would have been).

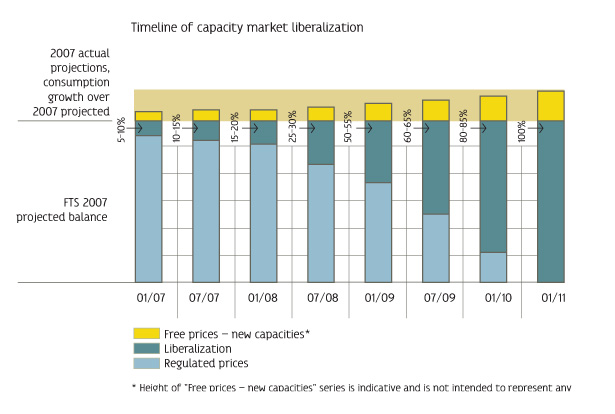

The Government is aiming to create a fully liberalized market by 2011, as reflected in its approval of the plan to ensure the safety of domestic gas and power supply at the meeting held on November 30, 2006 and subsequently anchored in the Government Resolution No. 205 dated April 7, 2007. The currently envisaged liberalization timetable according to this Resolution is as follows. The exact timeline and mechanism of capacity market liberalization are being considered and final decision can be expected in the near future.

Additional share issues and sale of government shares in generating companies

Electricity demand increase caused the quality changes in energy industry assets structure aimed at the energy companies’ effectiveness growth, and increase of investments to the industry.

The main sources of investments are:

- Additional share issues of RAO UES subsidiaries;

- Shares’ sale to strategic investor or public offering of government stakes (through RAO UES ownership) in generating companies.

Thus, the investors will be able to get stakes in generating companies (WGCs and TGCs) composed within the reform. It is the necessary condition of target sector structure in terms of market liberalization.