Analysis of RAS Financial Results

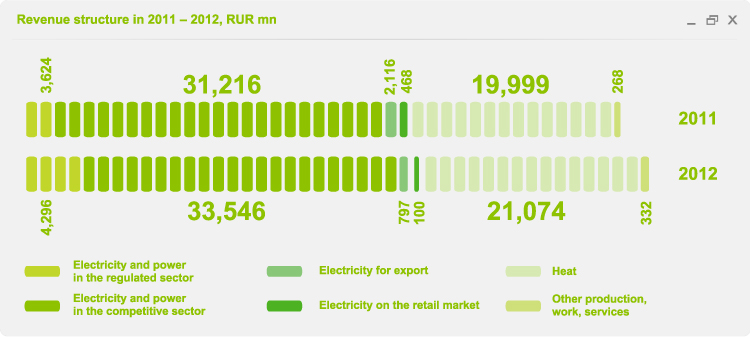

TGC-1's revenues in 2012 were generated by sales of heat, electricity and power on the wholesale and retail markets, export supply, as well as sales of other products, work and services.

In 2012, TGC-1's revenues increased by 4.3 % compared to 2011 and amounted to RUR 60,145 million. The growth of total revenue is associated with: the increase in electricity and capacity sales as a result of an increase in electric power stations generation; the growth in regulated and unregulated prices of electricity and power; the commissioning of a second CCGT-180 MW unit at the Pervomayskaya CHPP under CSA; and the increase in average tariffs on heat by 4.6 % relative to 2011. Revenues from other production, work and services increased due to growth in revenues from services connecting consumers to heating networks.

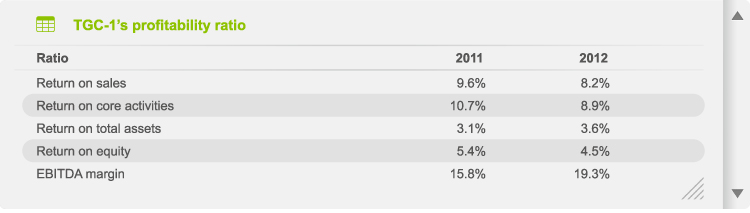

The Company's margin on sales in 2012 decreased to 8.2 % from 2011's 9.6 % due to a decrease in gross profit.

The cost of production and sale of products, work and services in 2012 amounted to RUR 55,243 million, which includes the cost of core activities at RUR 55,090 million and other activities at RUR 153 million. The main share of the cost is made up of expenses on electricity production at RUR 32,172 million and heat production at RUR 22,918 million.

.

In 2012, the cost of core operating activities increased by RUR 3,099 million compared to analogous figures in 2011. The main reasons for the change in cost value are the increase in fuel prices in connection with a greater volume of production programmes, and the increase in depreciation charges associated with the commissioning of the second CCGT-180 MW unit at the Pervomayskaya CHPP.

Due to increased efficiency of operating activities, the EBITDA for 2012 totalled RUR 11,595 million, which is RUR 2,490 million more than in 2011. The main factors in the growth of this indicator are the Company's additional income from sales of assets in the second half of 2012, and savings on items such as repair costs, labor costs, tax payments (not including income tax), as well as an increase in depreciation.

Profits from sales in 2012 decreased by RUR 654 million and amounted to RUR 4,902 million. Pre-tax profit was RUR 4,406 million. The Company's net profit for 2012 amounted to RUR 3,353 million, down by RUR 404 million from 2011.

Analysis of Financial Situation

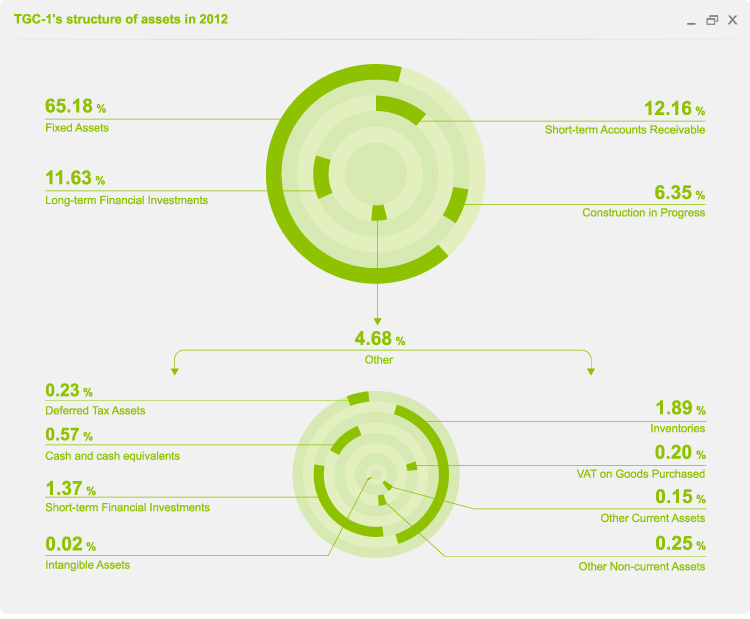

Structure of Assets

As of 31.12.2012, the balance sheet total stood at RUR 121,673,387 thousand. Non-current assets make up 83.7 % of the Company's total assets, of which a large part falls within fixed assets. The value of fixed assets for 2012 increased by RUR 15,093,256 thousand as a result of the commissioning of the Pravoberezhnaya CHPP's CCGT-450 MW unit, completion of a number of works on the reconstruction of the Vuoksa HPPs Cascade and parts of other measures that were carried out as part of the Company's Investment Programme implementation.

Long-term financial investments account for 11.6 % of total assets. Growth was achieved as a result of the monetary payment for additional shares in Hibiny Heat Company JSC, in order to preserve TGC-1's 50 % participation share in authorized capital.

The total share of current assets amounts to 16.3 %. At the end of 2012, the Company's current assets increased by 7 % compared to 2011, mainly due to the increase in current receivables to RUR 1,306,005 thousand.

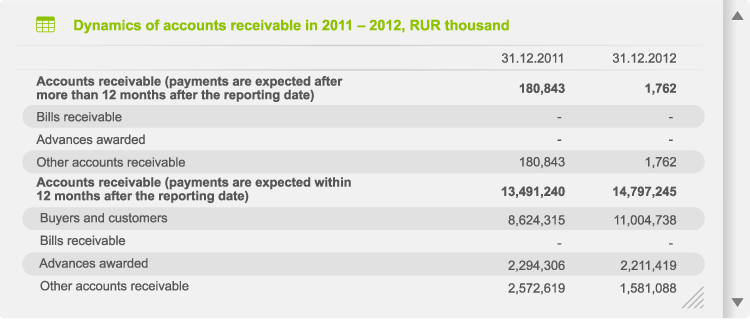

As of 31.12.2012, the total sum of accounts receivable is RUR 14,799,007 thousand, increasing by RUR 1,126,924 thousand in 2012. The increase in accounts receivable during the reporting period is a result of the increase in current accounts receivable from other electric and heat consumers. The Company is constantly working to collect accounts receivable.

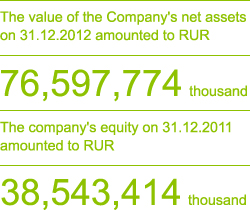

The value of the Company's net assets on 31.12.2012 amounted to RUR 76,597,774 thousand. The company's equity on 31.12.2011 amounted to RUR 38,543,414 thousand, which is less than the Company's net assets. This satisfies the requirements of Article 35 of the Law "On Joint Stock Companies" and characterizes the enterprise as a confident player on the forward market.

Structure of liabilities

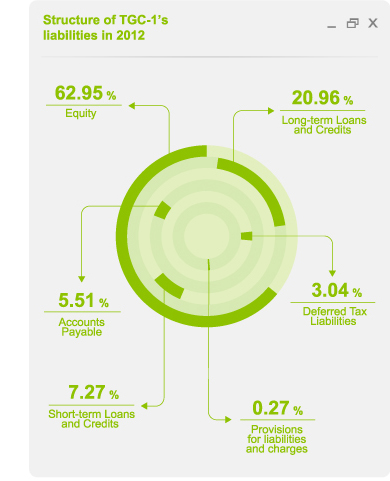

As of 31 December 2012 the Capital and Reserves accounts for the largest part of the balance sheet amounting to 63 % or RUR 76,597,774 thousand. Long-term liabilities are shown in items Borrowings and Banking Loans amounting to RUR 25,498,687 thousand or 21 %, Deferred Tax Liabilities are RUR 3,698,783 thousand or 3 %.

Short-term loans and credit amounted to 7.3 % of the balance or RUR 8,851,093 thousand. Overall in 2012, the Company's credit portfolio increased by RUR 1,863,109 thousand and amounted to RUR 34,349,780 thousand. In comparison with 2011, changes took place in the structure of loan capital in the direction of increasing long-term borrowed funds and reducing the Company's short-term debt. The total volume of credit decreased from 81.3 % to 72.8 %, but the total number of loans in turn increased from 18.7 % to 27.3 %. This increase in the level of borrowing in the capital structure of the Company is within acceptable means in terms of ensuring the necessary level of financial stability.

The average weighted rate of the credit portfolio at the end of 2012 was 8.11 % per annum, which is an increase of 0.01 % compared to 2011. There are no debt arrears for credits and loans. The Company fully satisfies the terms stipulated in credit agreements.

On 31.12.2012, the total amount of accounts receivable stood at RUR 6,699,772 thousand. The decrease compared to 2011 was achieved by reducing the debt by advance payments received by RUR 311,186 thousand and reducing debts to other creditors by RUR 357,476 thousand. All debts are currently formed by terms of payment contracts.

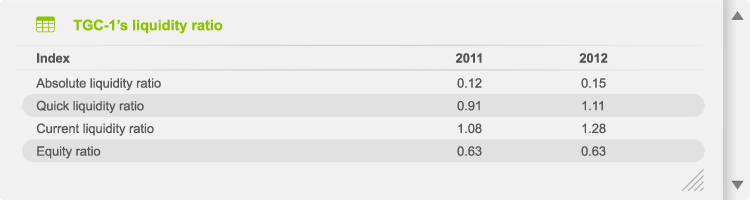

Liquidity Analysis

Liquidity ratios for 2012 showed a positive trend compared to 2011. The growth of these values is a result of systematic measures to reduce short-term loans and the Company's borrowing for the compliance with all established limits on credit policy.

Profitability Analysis

Profit margins for 2012 demonstrate negative growth, with the exception of return on aggregate capital and profitability by EBITDA, whose positive trend provided growth of the Company's other income in the reporting year as a result of marginal asset sales. Reasons for the decline in profitability, with the exception of return on aggregate capital and profitability by EBITDA, are the decrease in prices of electricity on the day-ahead market, the reduction in 2012 of power volumes that are supplied by essential generation plants, the reduction in export volumes as a result of adverse conditions in the external market, and rising fuel costs and depreciation.

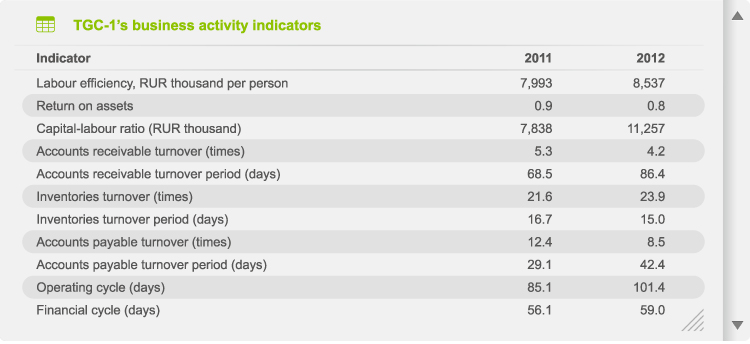

Analysis of Business Activity

Analysis of IFRS Financial Results

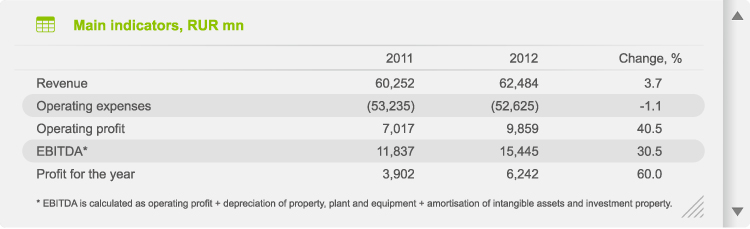

The Company's consolidated revenues for 2012 grew by 3.7 % compared to 2011 and amounted to RUR 62,484 million. The increase in revenue was influenced by:

- the launch of the CCGT-180 MW unit at the Pervomayskaya CHPP onto the wholesale market;

- growth in hydroelectric power generation due to high water content in the second half of 2012;

- connecting new heat consumers, as well as an increase in heat tariffs.

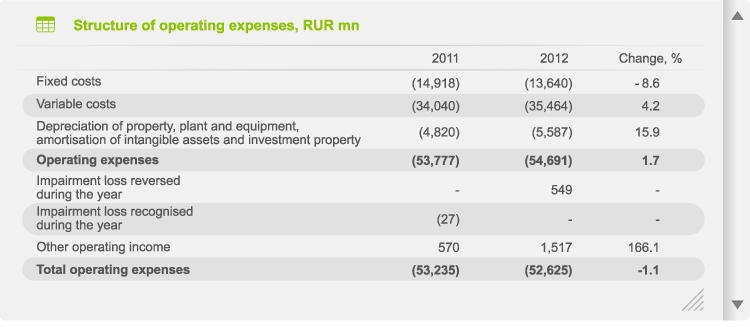

Operating expenses in 2012 grew by 1.7 % to RUR 54,691 million compared to the previous reporting period. The increase occurred in variable costs and the increase in depreciation.

The change in operating expenses was influenced by the following factors:

- fuel costs increased by 9.3 % to RUR 27,214 million, due to increased production of electricity as well as gas price indexation;

- an increase in depreciation and amortisation by 15.9 % to RUR 5,587 million in connection with the commissioning of new equipment;

- a reduction in costs of purchased electricity and heat by 17.5 % to RUR 4,901 million, associated with a fall in prices on the spot market and the balancing market, as well as a significant decrease in the volume of purchases for supplying electricity exports;

- profits of RUR 561 million from the sale of non-core assets.

The reduction in fixed costs by 8.6 % was mainly due to the decrease in provisions for doubtful accounts receivable that were repaid in 2012, and a decrease in tax expenses on assets associated with vested benefits.

Operating profits for 2012 increased by 40.5 % to RUR 9,859 million. EBITDA grew by 30.5 % to RUR 15,445 million, of which RUR 1,358 million were received as a result of successful implementation of programme initiatives to enhance shareholder value (the effect of the programme is designed based on management accountability). Profit increased by 60 % to RUR 6,242 million.